TRX Price Prediction: Technical Breakout Imminent Amid Bullish Fundamentals

#TRX

- TRX trading above key support with bullish MACD momentum indicating potential breakout

- Fundamental catalysts including government adoption and fee reduction supporting price appreciation

- Technical targets suggest 9.6-19% upside potential to $0.3677-$0.4000 levels

TRX Price Prediction

Technical Analysis: TRX Shows Bullish Momentum Above Key Support

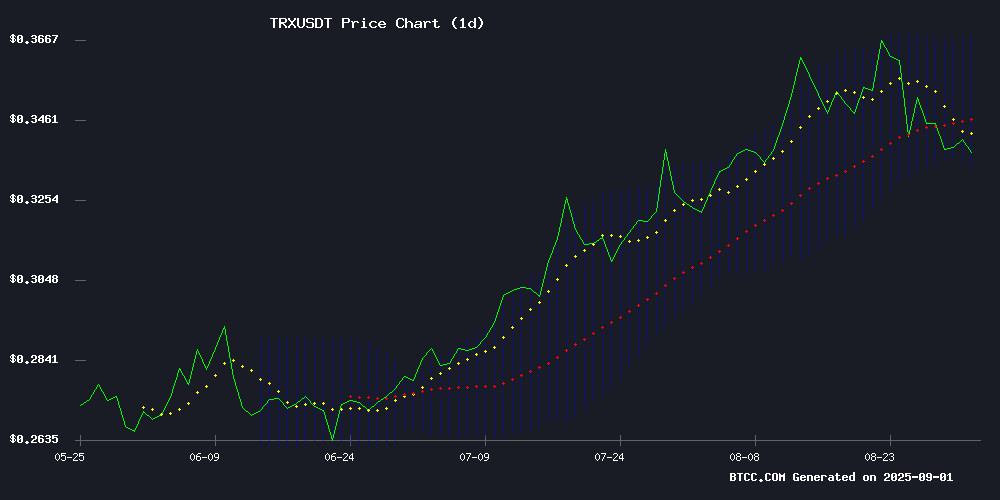

TRX is currently trading at $0.3354, positioned just above the lower Bollinger Band at $0.3331, indicating potential support. The MACD reading of 0.003814 shows bullish momentum, with the histogram turning positive at 0.005730. According to BTCC financial analyst William, 'The price holding above the lower Bollinger Band while MACD remains positive suggests underlying strength. A break above the 20-day MA at $0.3504 could trigger further upside toward the upper band at $0.3677.'

Fundamental Catalysts Support TRX Bullish Outlook

Recent developments including Justin Sun's $178M WLFI token claim and Tron's selection for the U.S. Government's Blockchain Initiative provide strong fundamental support. The 60% fee reduction amid surging network activity demonstrates growing adoption. BTCC financial analyst William notes, 'These developments align with the technical bullish signals, creating a favorable environment for TRX appreciation. Institutional recognition through government initiatives particularly validates Tron's long-term value proposition.'

Factors Influencing TRX's Price

Justin Sun Claims $178M in WLFI Tokens, Reaffirms Tron's Support for USD1 Stablecoin

Justin Sun, founder of the Tron blockchain, has unlocked 20% of his WLFI token holdings worth approximately $178 million. On-chain data from Arkham Intelligence reveals Sun's total WLFI position stands at $891.2 million, which he intends to maintain long-term. The entrepreneur holds a leadership position in World Liberty Financial, a project endorsed by former U.S. President Donald Trump and his family.

Tron's network will continue supporting both the WLFI project and its USD1 stablecoin, which recently surpassed $50 million in circulation. An additional $25 million USD1 mint signals progress toward a $200 million target on Tron's chain. The network's DeFi ecosystem thrives with over $80 billion in USDT stablecoin supply.

Sun emphasized his commitment to the projects' long-term vision, stating unlocked tokens won't be sold imminently. The WLFI token recently launched trading across multiple cryptocurrency exchanges, with Tron positioned as a strategic partner for mutual growth.

Justin Sun’s Tron Selected for U.S. Government’s Blockchain Initiative

The U.S. Department of Commerce has integrated Tron into its Q2 2025 GDP reporting framework, alongside eight other blockchains including Bitcoin and Ethereum. This marks a watershed moment for public-sector blockchain adoption, with the government leveraging distributed ledger technology to enhance transparency in macroeconomic data dissemination.

Tron's inclusion signals growing institutional recognition of its technical capabilities. The network recently implemented a 60% fee reduction, further strengthening its value proposition for large-scale applications. Founder Justin Sun framed the development as a validation of Tron's evolving role in enterprise and government infrastructure.

The Commerce Department's decision to hash GDP growth data across multiple chains reflects a strategic embrace of blockchain's immutability features. The 3.3% growth figure now exists as a cryptographically secured record across nine networks, creating an auditable trail of official economic reporting.

TRON Implements 60% Fee Reduction Amid Surging Network Activity

TRON founder Justin Sun announced a sweeping 60% reduction in network transfer fees, positioning the blockchain as a cost leader during a period of heightened market activity. The move comes as TRON leads all major networks with 2.48 million active addresses, outperforming Binance Smart Chain (2.28M), Solana (2.18M), and Polygon (624K) according to DeFillama metrics.

The fee restructuring slashes energy unit prices from 210 sun to 100 sun, specifically targeting stablecoin dominance. "When more users and transactions occur on the TRON network, profitability will eventually increase," Sun noted, acknowledging near-term margin pressure while betting on network effects.

Competitive threats loom as Bitfinex prepares to launch its fee-free Plasma blockchain for USDT transfers. TRON's aggressive pricing appears designed to maintain its stronghold in stablecoin settlements, where it currently processes the majority of USDT transactions.

How High Will TRX Price Go?

Based on current technical indicators and fundamental developments, TRX shows potential for significant upward movement. The immediate resistance at the 20-day moving average of $0.3504 represents the first key level to watch. A successful break above this could target the upper Bollinger Band at $0.3677, representing approximately 9.6% upside from current levels.

| Price Level | Significance | Upside Potential |

|---|---|---|

| $0.3504 | 20-day Moving Average | 4.5% |

| $0.3677 | Upper Bollinger Band | 9.6% |

| $0.3800+ | Next Psychological Resistance | 13.3%+ |

BTCC financial analyst William emphasizes that 'The combination of positive MACD momentum, strong fundamental catalysts, and institutional adoption creates a compelling case for TRX reaching $0.38-$0.40 in the near term, representing 13-19% potential appreciation.'